Your Colorado tax exempt certificate images are ready. Colorado tax exempt certificate are a topic that is being searched for and liked by netizens now. You can Get the Colorado tax exempt certificate files here. Get all free vectors.

If you’re looking for colorado tax exempt certificate pictures information connected with to the colorado tax exempt certificate keyword, you have visit the ideal site. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly surf and find more informative video articles and images that match your interests.

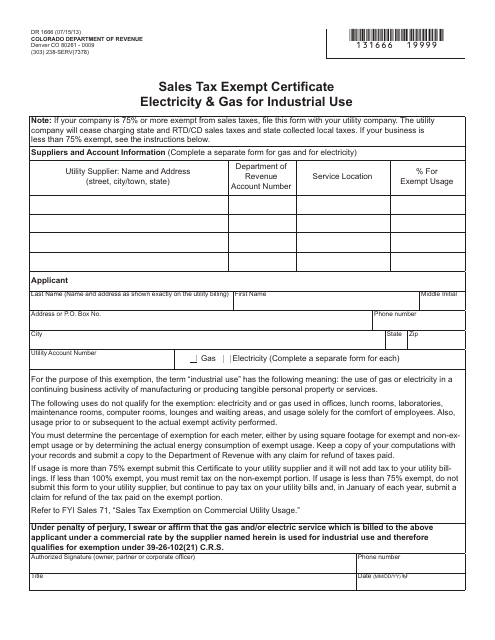

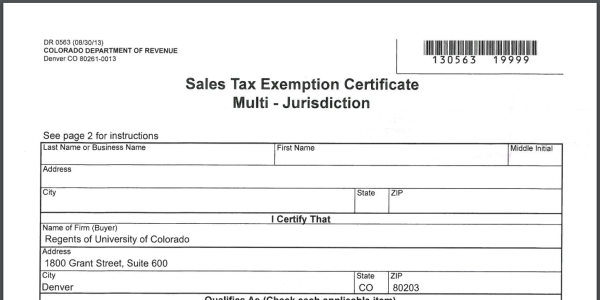

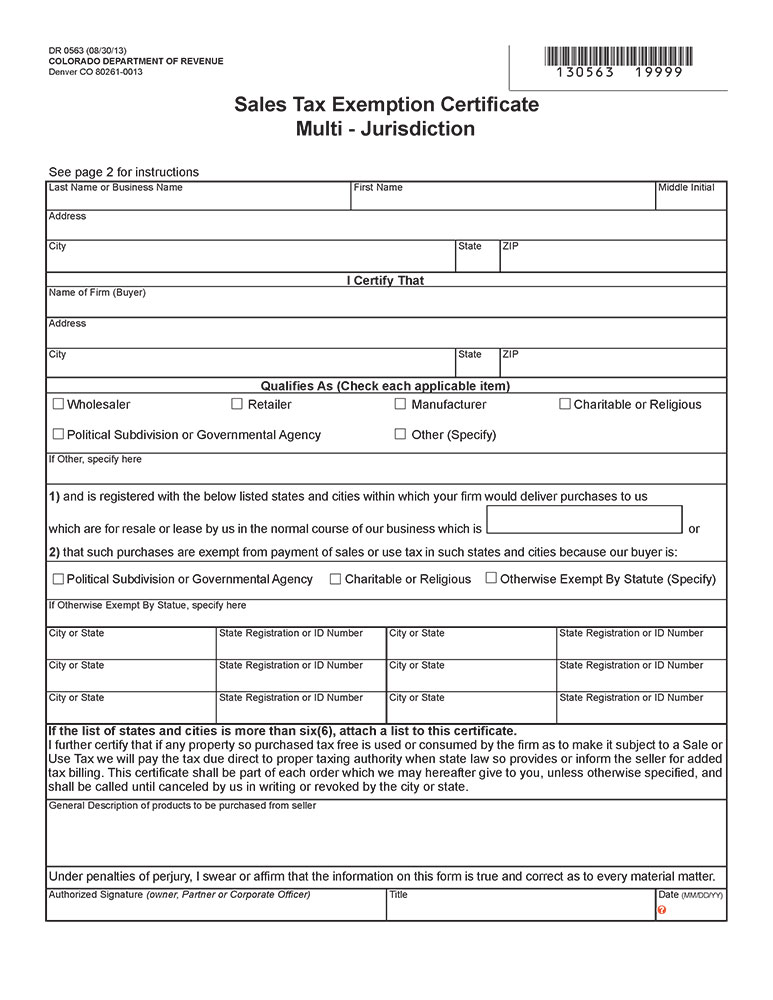

Colorado Tax Exempt Certificate. A retailer may also accept from an out-of-state purchaser a fully completed Standard Colorado Affidavit of Exempt Sale DR 5002 Sales Tax Exemption Certificate DR 0563 or Multistate Tax Commission. However if requested following are the pertinent numbers to use. Ad Fill out a simple online application now and receive yours in under 5 days. When retailers buy goods to resell they often do not pay sales tax to the supplier.

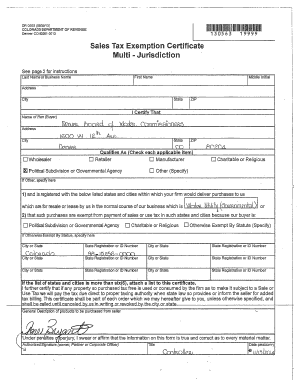

Co Form Dr 0563 From pdfprof.com

Co Form Dr 0563 From pdfprof.com

Colorado provides an exemption for organizations that have been certified exempt under 501c3 of the Internal Revenue Code. This document covers the entire state and is. If we do not have this certificate we are obligated to collect the tax for the state in which the property. Colorado contractor tax exempt certificate provides a comprehensive and comprehensive pathway for students to see progress after the end of each module. To do so the retailer must provide their vendor with a Colorado Sales Tax Exemption Certificate. It is not required that governmental entities present a Colorado issued tax-exemption number in order to make a tax exempt purchase.

Ad 5 Minute Online Certificate Application for Small Businesses with less than 50 employees.

This document covers the entire state and is. Download Or Email DR 0563 More Fillable Forms Register and Subscribe Now. Application for Property Tax Exemption. Residential Properties Specific Forms For Charitable-Residential Properties Additional Forms Late Filing Fee Waiver Request Remedies for Recipients of Notice of. How to use sales tax exemption certificates in Colorado. Sales of exempt drugs and medical devices.

Source: templateroller.com

Source: templateroller.com

When retailers buy goods to resell they often do not pay sales tax to the supplier. How to use sales tax exemption certificates in Colorado. Residential Properties Specific Forms For Charitable-Residential Properties Additional Forms Late Filing Fee Waiver Request Remedies for Recipients of Notice of. If we do not have this certificate we are obligated to collect the tax for the state in which the property. In order to do so the retailer will need to provide a Colorado Sales Tax Exemption Certificate to their.

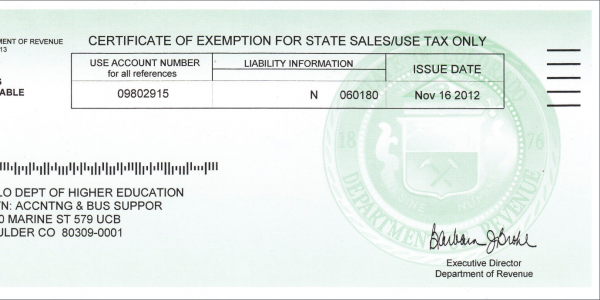

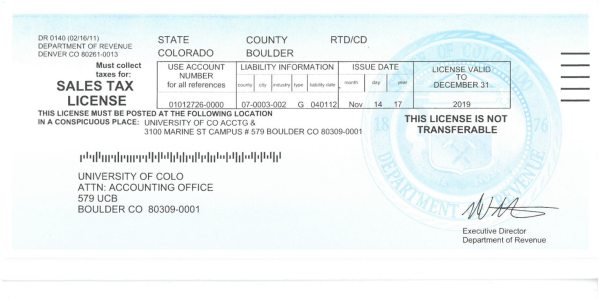

Source: colorado.edu

Source: colorado.edu

Sales of exempt drugs and medical devices. You can download a PDF of the. Ad Fill out a simple online application now and receive yours in under 5 days. It is not required that governmental entities present a Colorado issued tax-exemption number in order to make a tax exempt purchase. Ad Fill out a simple online application now and receive yours in under 5 days.

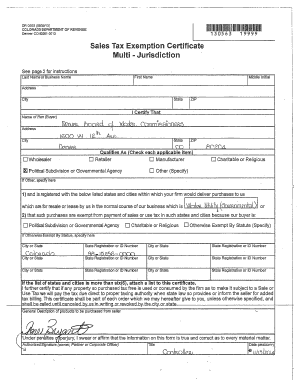

Source: pdffiller.com

Source: pdffiller.com

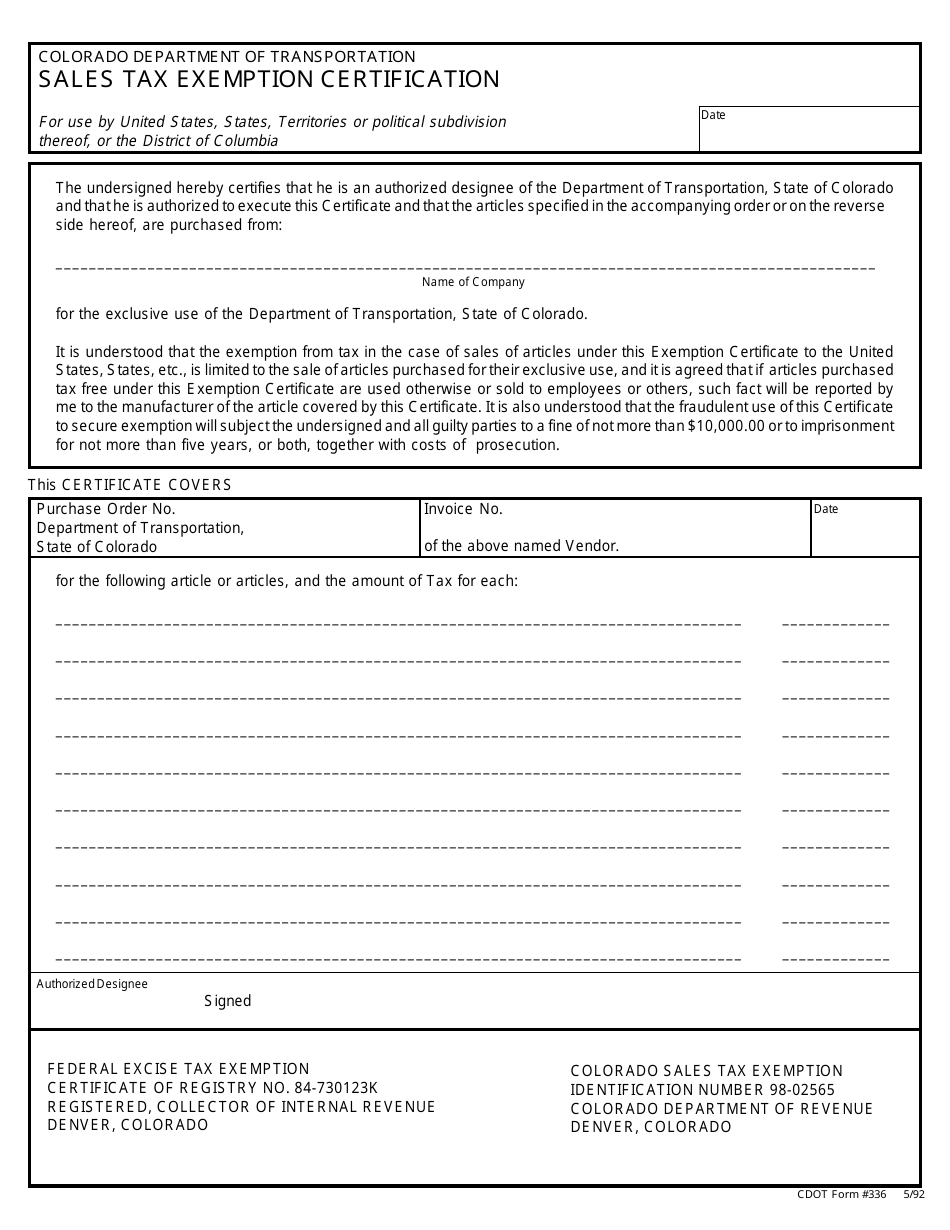

Colorado provides an exemption for organizations that have been certified exempt under 501c3 of the Internal Revenue Code. See CDOTs state tax-exempt certificate number federal excise tax-exemption number and federal tax identification number. Sales of exempt drugs and medical devices. Download Or Email DR 0563 More Fillable Forms Register and Subscribe Now. University of Colorado at Boulder Boulder Tax Exempt Number.

Source: startingyourbusiness.com

Source: startingyourbusiness.com

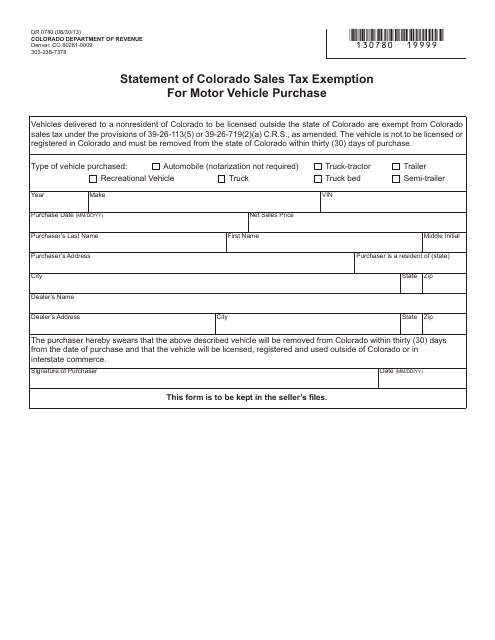

Yet another type of tax exemption certificate is the direct. However if requested following are the pertinent numbers to use. Ad Fill out a simple online application now and receive yours in under 5 days. Ad Fill out a simple online application now and receive yours in under 5 days. In order to do so the retailer will need to provide a Colorado Sales Tax Exemption Certificate to their.

Source: pdfprof.com

Source: pdfprof.com

However if requested following are the pertinent numbers to use. How to use sales tax exemption certificates in Colorado. A certificate of exemption issued by the Department of Revenue or any other taxing authority does not authorize exemption from the City of Colorado Springs sales or use tax on construction materials. Contractors who will be working on governmental projects may qualify for usage-based exemption certificates as agents of a government entity. A retailer may also accept from an out-of-state purchaser a fully completed Standard Colorado Affidavit of Exempt Sale DR 5002 Sales Tax Exemption Certificate DR 0563 or Multistate Tax Commission.

Source: salestaxhandbook.com

Source: salestaxhandbook.com

However if requested following are the pertinent numbers to use. A certificate of exemption issued by the Department of Revenue or any other taxing authority does not authorize exemption from the City of Colorado Springs sales or use tax on construction materials. Bad debts charged-off returned goods trade discounts and allowances where tax as paid cash discounts. Ad 5 Minute Online Certificate Application for Small Businesses with less than 50 employees. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free.

Source: colorado.edu

Source: colorado.edu

In order to do so the retailer will need to provide a Colorado Sales Tax Exemption Certificate to their. See CDOTs state tax-exempt certificate number federal excise tax-exemption number and federal tax identification number. Sales of exempt drugs and medical devices. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free. To do so the retailer must provide their vendor with a Colorado Sales Tax Exemption Certificate.

Source: startingyourbusiness.com

Source: startingyourbusiness.com

When a business purchases inventory to resell they can do so without paying sales tax. Ad Complete Tax Forms Online or Print Official Tax Documents. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Colorado sales tax. Contractors who will be working on governmental projects may qualify for usage-based exemption certificates as agents of a government entity. Bad debts charged-off returned goods trade discounts and allowances where tax as paid cash discounts.

Source: templateroller.com

Source: templateroller.com

With a team of extremely dedicated and quality. Ad Complete Tax Forms Online or Print Official Tax Documents. Ad 5 Minute Online Certificate Application for Small Businesses with less than 50 employees. A certificate of exemption issued by the Department of Revenue or any other taxing authority does not authorize exemption from the City of Colorado Springs sales or use tax on construction materials. Fast Same Day Online State Resale Certificate for New Small Businesses.

Source: pdffiller.com

Source: pdffiller.com

Ad Fill out a simple online application now and receive yours in under 5 days. Residential Properties Specific Forms For Charitable-Residential Properties Additional Forms Late Filing Fee Waiver Request Remedies for Recipients of Notice of. Ad 5 Minute Online Certificate Application for Small Businesses with less than 50 employees. In order to do so the retailer will need to provide a Colorado Sales Tax Exemption Certificate to their. You can download a PDF of the.

Source: templateroller.com

Source: templateroller.com

You can download a PDF of the. How to use sales tax exemption certificates in Colorado. When a business purchases inventory to resell they can do so without paying sales tax. Sales of exempt drugs and medical devices. Download Or Email DR 0563 More Fillable Forms Register and Subscribe Now.

Source: formupack.com

Source: formupack.com

Colorado contractor tax exempt certificate provides a comprehensive and comprehensive pathway for students to see progress after the end of each module. Ad 5 Minute Online Certificate Application for Small Businesses with less than 50 employees. 84-6000555 Federal Excise Tax Exemption Register Number. With a team of extremely dedicated and quality. Bad debts charged-off returned goods trade discounts and allowances where tax as paid cash discounts.

Source: colorado.edu

Source: colorado.edu

When retailers buy goods to resell they often do not pay sales tax to the supplier. Sales of gasoline dyed diesel and other exempt fuels. Application for Property Tax Exemption. Colorado provides an exemption for organizations that have been certified exempt under 501c3 of the Internal Revenue Code. When retailers buy goods to resell they often do not pay sales tax to the supplier.

Colorado provides an exemption for organizations that have been certified exempt under 501c3 of the Internal Revenue Code. 84-6000555 Federal Excise Tax Exemption Register Number. Contractors who will be working on governmental projects may qualify for usage-based exemption certificates as agents of a government entity. When retailers buy goods to resell they often do not pay sales tax to the supplier. Tax exempt certificate numbers.

Source: startingyourbusiness.com

Source: startingyourbusiness.com

Tax exempt certificate numbers. When retailers buy goods to resell they often do not pay sales tax to the supplier. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Colorado sales tax. Download Or Email DR 0563 More Fillable Forms Register and Subscribe Now. This document covers the entire state and is.

As a public institution of higher education the University of Colorado Colorado Springs is exempt by law from all federal excise taxes and from all Colorado State and local. When a business purchases inventory to resell they can do so without paying sales tax. Sales of exempt drugs and medical devices. A retailer may also accept from an out-of-state purchaser a fully completed Standard Colorado Affidavit of Exempt Sale DR 5002 Sales Tax Exemption Certificate DR 0563 or Multistate Tax Commission. Colorado contractor tax exempt certificate provides a comprehensive and comprehensive pathway for students to see progress after the end of each module.

Source: form-dr-0172.pdffiller.com

Source: form-dr-0172.pdffiller.com

Download Or Email DR 0563 More Fillable Forms Register and Subscribe Now. University of Colorado at Boulder Boulder Tax Exempt Number. With a team of extremely dedicated and quality. This document covers the entire state and is. Application for Property Tax Exemption.

Source: trivantage.com

Source: trivantage.com

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Colorado sales tax. Bad debts charged-off returned goods trade discounts and allowances where tax as paid cash discounts. This document covers the entire state and is. Sales of exempt drugs and medical devices. A certificate of exemption issued by the Department of Revenue or any other taxing authority does not authorize exemption from the City of Colorado Springs sales or use tax on construction materials.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title colorado tax exempt certificate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.